views

Bunker Fuel Market: Introduction

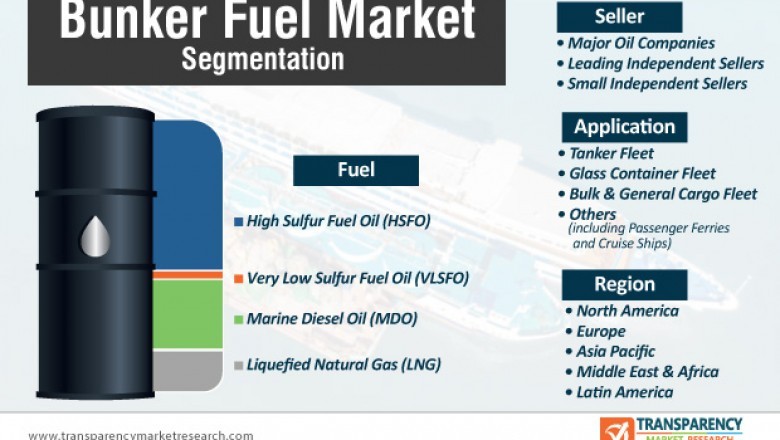

The global bunker fuel market was valued at US$ 143.97 Bn in 2018 and is anticipated to expand at a CAGR of 2.5% during the forecast period. Based on fuel, the High Sulfur Fuel Oil (HSFO) segment held a dominant share of the global bunker fuel market in 2018, as HSFO is a widely used bunker fuel by fleet owners due to its lower price than other types of fuels. However, implementation of the IMO 2020 regulation is expected to restrict the use of HSFO owing to the high sulfur content. The new global limits on sulfur content for marine fuels are estimated to significantly impact bunker fuel market.

In terms of seller, the leading independent sellers segment accounted for a dominant share of the global bunker fuel market in 2018. Leading independent distributors have well-established setup that includes blending facility, storage terminals, and own physical assets. Based on application, the tanker fleet segment constituted prominent share of the global bunker fuel market in 2018, due to the rise in demand for crude oil, petroleum products, chemicals, and liquid raw material in various regions. The tanker fleet segment comprises specialized purpose-built vessels designed to carry liquefied petroleum gas (LPG) or liquefied natural gas (LNG) under pressure. The bunker fuel market in Asia Pacific is likely to expand at a substantial pace during the forecast period, owing to rapid urbanization and industrialization in the region.

Download PDF Brochure - https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=3894

Key Drivers of Bunker Fuel Market

Rise in international seaborne trade is boosting the global bunker fuel market. The global seaborne trade is performing well, supported by the upswing in the world economy. Seaborne trade leads to shipping, intercontinental trade, bulk transport of raw materials, and import/export of affordable food and manufactured goods. Increase in offshore exploration and production, due to the rise in demand for resources such as crude oil, coal, steel, and iron, is estimated to propel the demand for bunker fuel in the near future. Rapid technological development has boosted oil & gas exploration activities at deep offshore locations and other marginal oil & gas fields.

Companies supplying bunker fuel have strategically opened bunkering divisions in ports that are close to major offshore hydrocarbon basins, as bunkering requirements are significantly high for some offshore support vessels. Thus, growth in offshore exploration and production activities is projected to drive the global bunker fuel market in the near future.

More Trending Reports by Transparency Market Research - https://www.prnewswire.co.uk/news-releases/global-artificial-lift-systems-market-to-earn-revenue-worth-us-12-3-bn-by-2027-growing-at-a-cagr-of-5-0-over-2019-to-2027-transparency-market-research-853459071.html

Asia Pacific Offers Lucrative Opportunities in Bunker Fuel Market

Asia Pacific is anticipated to be a highly attractive region of the global bunker fuel market during the forecast period, due to rapid industrialization and urbanization in the region, especially in countries such as China, India, and Japan. Furthermore, ports in China account for nearly a third of global container traffic. The country has the largest merchant fleet in the world in terms of number of ships. However, Singapore dominates the bunker fuel market in Asia. Around 48 million metric tons to 50 million metric tons of bunker fuel were sold in Singapore in 2018, making it the world’s largest bunkering hub. The country dominates the market due to its vast commercial storage capacity and fuel blending capabilities.

Request for Discount on This Report at - https://www.transparencymarketresearch.com/sample/sample.php?flag=D&rep_id=3894

Major Developments in Bunker Fuel Market

In March 2019, BP Marine announced that it would begin to retail low sulfur bunker fuel that meets new MARPOL regulations that limit the sulfur content of marine fuels. The company is introducing a new very low sulfur fuel oil (VLSFO), with maximum 0.5% sulfur content, following successful sea trials with fuel manufactured and supplied in the Amsterdam/Rotterdam/Antwerp (ARA) and Singapore hubs.

In October 2019, Total launched its first large liquefied natural gas (LNG) bunker vessel. The bunker vessel is expected to operate in Northern Europe and supply LNG to commercial vessels. The use of LNG sharply reduces emissions from ships, resulting in significant improvement in air quality, particularly for communities in coastal areas and port cities.

Request for covid19 Impact Analysis - https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=3894

Competition Landscape

The global bunker fuel market is dominated by multinational as well as small players operating across the globe. Prominent players operating in the global bunker fuel market include Total, Neste, Marathon Petroleum Corporation, Brightoil Petroleum (Holdings) Limited, BP., Saudi Arabian Oil Co., Gazprom, LUKOIL, BP Sinopec Marine Fuels, Chevron U.S.A. Inc., Exxon Mobil Corporation, Royal Dutch Shell plc, World Fuel Services Corporation., GAC, and BUNKER HOLDING.