views

The currency swap:

If you regularly trade the stock market, you already know that the stock market is characterized by frequent fluctuations in the exchange rates on which you speculate. As part of this activity, you have probably already heard of currency swaps. In this article we are going to talk a little more about this concept so that you can better understand how it works.

Definition of currency swap:

The currency swap is also known by its name in English, "currency swap". In reality, it is an exchange of capital between two companies and in two different currencies. It can also be a simple currency exchange between two parties. A currency swap is also subject to conditions that allow the relative value of the assets to be determined, such as the purchase and sale value of each of the currencies or the interest rate of the countries that issue them.

Within the framework of a currency swap, the two parties thus undertake to exchange the principal sum of a loan in a currency and the interest that is applied during a specific period, Token swap platform development in exchange for a sum that corresponds to the applicable interest. in the second currency. We often use currency swaps to exchange fixed-rate debt payments for variable-rate debt payments, that is, debt whose payment may vary depending on the evolution of interest rates. However, these swaps can also be used for fixed rate transactions.

Why is a currency swap interesting?

Companies that carry out currency swaps generally do so with the aim of obtaining a loan at a better rate than the local market offers, in addition to locking in a specific exchange rate in advance for the servicing of a title. credit in a foreign currency.

Currency swaps were created by British financial institutions during the 1970s to evade the controls imposed on currencies at the time. However, it was in 1981 when the swap market was launched as part of a World Bank operation to reduce its exposure to interest rates for a loan in dollars on the US markets in exchange for obligations in Swiss francs and in deutsche marks in possession of IBM .

FX swaps and their particularities:

There is also another type of swap called the “FX swap” and which has some peculiarities. The FX swap does not propose an exchange of interest during the duration of the contract, but rather the sum of the funds exchanged is different at the end of the contract. We often use these FX swaps with the aim of reducing currency risk while currency swaps are also used to offset currency and interest rate risks. In this way, multinational companies or financial institutions use them to finance investments in currencies with variable durations that can reach up to 30 years.

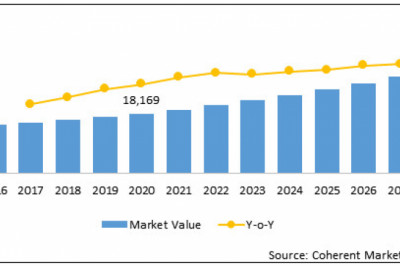

For their part, FX Swaps are used more by exporters or importers, as well as institutional investors, who are looking for coverage. Its average duration varies between one day and one year. For some years, and according to the statistics and research carried out by the BIS (Bank for International Settlements) regarding central banks, it appears that FX swaps are the most frequently traded foreign exchange instruments and represent a large part of transactions made with currencies. Forex swap trading volume, meanwhile, is considerably lower, accounting for just a quarter of the volume of FX swaps.

In a classic currency swap transaction, one party will borrow a sum of currency from the other at the prevailing exchange rate. At the same time, he lends a sum that corresponds to the counterpart in the currency he owns. During the contract, each of the parties will give the other some interest in the currency of the principal sum that it has received. At the end of the contract, the two parties reimburse each other.

For example, imagine a currency swap between a US company and a French company. The French company borrows one billion dollars and lends 500 million euros to the American company with an exchange rate of two dollars per euro. During the term of the contract, the French company will regularly receive an interest payment in euros from the US company and a base price against the swap. She will pay the US company in dollars at the prevailing exchange rate. At the end of the contract, the French company will deliver a capital of one billion dollars to the American company, and will receive from it the 500 million euros delivered.